California Lease Agreement

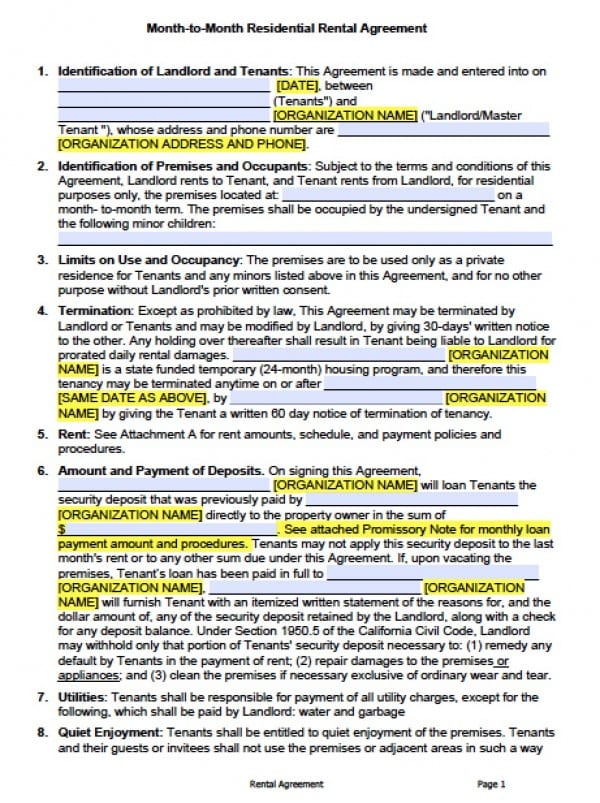

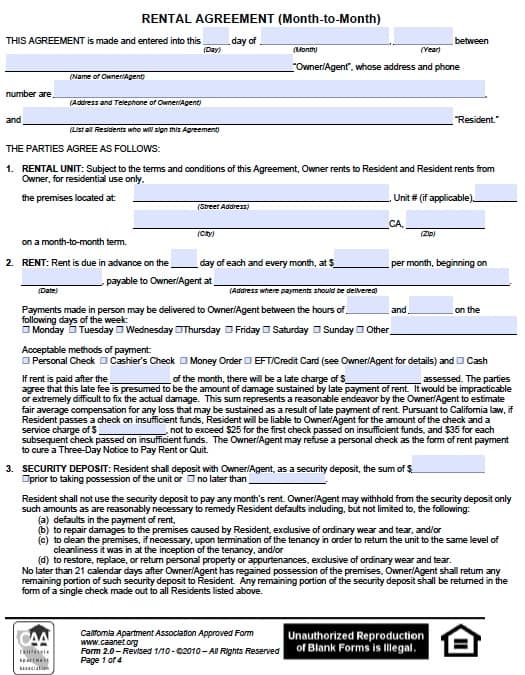

California Lease Agreement Sample

California’s Vehicle Leasing Act (Civil Code §§ 2985.7 – 2993) is the California supplement to the federal Consumer Leasing Act (15 U.S.C. §§ 1667-1667t). The Vehicle Leasing Act incorporates the requirement of the federal statute, and goes further imposing more detailed disclosures and making them mandatory for all automobile lease contracts entered into in California.For attorneys, and other persons with legal training, below is the complete text of the Vehicle Leasing Act (current as of August 2015).

INDEXSection 2985.7.Definitions. “Motor vehicle” means any vehicle required to be registered under the Vehicle Code.

Section 2986.4.Acknowledgment by lesseeAny acknowledgment by the lessee of delivery of a copy of a lease contract or purchase order and any vehicle lease proposal and any credit statement which the lessor has required or requested the lessee to sign, and which the lessee has signed, during the contract negotiations, shall be printed or written in size equal to at least 10-point bold type and, if contained in the contract, shall appear directly above the space reserved for the lessee’s signature. The lessee’s written acknowledgment, conforming to the requirements of this section, of delivery of a completely filled in copy of the contract, and a copy of such other documents shall be a rebuttable presumption of delivery in any action or proceeding by or against a third party without knowledge to the contrary when he or she acquired his or her interest in the contract. If such third party furnishes the lessee a copy of such documents, or a notice containing items set forth in subdivision (c) of, and stating that the lessee shall notify such third party in writing within 30 days if he or she was not furnished a copy of such documents, and no such notification is given, it shall be conclusively presumed in favor of such a third party that copies of the documents were furnished as required by this chapter.

Section 2986.5.Lease of used vehicle; Refund of excess fees. No person shall lease a used motor vehicle for operation on California highways if such vehicle does not meet all of the equipment requirements of Division 12 (commencing with Section 24000) of the Vehicle Code. Section 2986.6.Lien on other propertyNo agreement in connection with a lease contract which provides for the inclusion of title to or a lien upon any personal or real property, other than the motor vehicle which is the subject matter of the lease contract, or accessories therefor, or special and auxiliary equipment used in connection therewith, as security for the payment of the contract obligations, shall be enforceable. This section does not apply to a security deposit, advance payment of rent or other cash prepayment. Section 2986.10.Rights of assignee of lessor. An assignee of the lessor’s rights is subject to all equities and defenses of the lessee against the lessor, notwithstanding an agreement to the contrary, but the assignee’s liability may not exceed the amount of the obligation owing to the assignee at the time of the assignment.

The assignee shall have recourse against the lessor to the extent of any liability incurred by the assignee pursuant to this section regardless of whether the assignment was with or without recourse. Section 2987.Lessee’s liability on termination of lease contract. A lessee has the right to terminate a lease contract at any time prior to the scheduled expiration date specified in the lease contract. “The amount you owe for early termination will be no more than the difference between the Gross Early Termination Amount stated above and (1) the appraised value of the vehicle or (2) if there is no appraisal, the wholesale value specified in a recognized used vehicle value guide.You have the right to get a professional appraisal to establish the value of the vehicle for the purpose of figuring how much you owe on the lease. If you want an appraisal, you will have to arrange for it to be completed at least three days before the scheduled valuation date. The appraiser has to be an independent person acceptable to the holder of the lease. You will have to pay for the appraiser.

The appraised value will be considered final and binding on you and the holder of the lease.”To be inserted in all other circumstances. “The amount you owe for early termination will be no more than the difference between the Gross Early Termination Amount stated above and (1) the appraised value of the vehicle or (2) if there is no appraisal, either the price received for the vehicle upon disposition or a greater amount established by the lessor or the lease contract.You have the right to get a professional appraisal to establish the value of the vehicle for the purpose of figuring how much you owe on the lease. If you want an appraisal, you will have to arrange for it to be completed at least three days before the scheduled sale date of the vehicle. The appraiser has to be an independent person acceptable to the holder of the lease. You will have to pay for the appraiser. The appraised value will be considered final and binding on you and the holder of the lease.”. The lessee shall have no liability under subdivision (b) if the lessor or holder of the lease contract does not comply with this subdivision.

Section 2988.Lessee to bear risk of vehicle’s depreciation. The Legislature finds that it is necessary to provide some protection for consumers who enter into lease contracts in which the lessee will bear the risk of the motor vehicle’s depreciation. This section is intended to provide relief to the consumer when an ostensibly inexpensive lease contract establishes an excessively low level of periodic payment which results, conversely, in an excessively high liability being imposed on the lessee at the expiration of the lease term because the lessor has failed to act in good faith in either estimating a residual value of the motor vehicle or establishing a level of periodic payment which bears no reasonable relation to the motor vehicle’s reasonably expected depreciation during the lease term. Therefore, the lessor will have the obligation to act in good faith and to come forward with competent evidence showing that the estimated residual value was so determined given the circumstances existing at the inception of the lease contract.

Where the lessee is to bear the risk of the motor vehicle’s depreciation and the lessee’s liability on expiration of a consumer lease is based on the estimated residual value of the motor vehicle such estimated residual value shall be a reasonable approximation of the anticipated actual fair market value of the motor vehicle on lease expiration. There shall be a rebuttable presumption that the estimated residual value is unreasonable to the extent that the estimated residual value exceeds the actual residual value by more than three times the average payment allocable to a monthly period under the lease. The presumption stated in the preceding sentence shall not apply to the extent the excess of estimated over actual residual value is due to physical damage to the motor vehicle beyond reasonable wear and use, or to excessive use, and the lease may set standards for such wear and use if such standards are not unreasonable. For the purposes of this chapter, “fair market value” means the value the motor vehicle would have when sold in a commercially reasonable manner in the customary market for such motor vehicle.

Section 2988.9.Attorney’s fees and costsReasonable attorney’s fees and costs shall be awarded to the prevailing party in any action on a lease contract subject to the provisions of this chapter regardless of whether the action is instituted by the lessor, assignee, or lessee. Where the defendant alleges in his or her answer that he or she tendered to the plaintiff the full amount to which he or she was entitled, and thereupon deposits in court, for the plaintiff, the amount so tendered, and the allegation is found to be true, then the defendant is deemed to be the prevailing party within the meaning of this section. Section 2989.4.Duties of lessor. A lessor shall not:. Fail to register the leased vehicle pursuant to the lease contract. Advertise any specific vehicle in the inventory of the lessor for lease without identifying such vehicle by either its vehicle identification number or license number. Refuse to lease a vehicle to any creditworthy person at the advertised total price, exclusive of sales tax, vehicle registration fees and finance charges.

Notwithstanding, a lessor shall not suffer civil liability for a violation of this section. Section 2989.5.Production of lessor’s records. Except as provided in subdivision (c), a lessor shall make available to investigators of the Department of Motor Vehicles, upon presentation of an affidavit that the department has a consumer complaint within its jurisdiction, the records relevant to the transaction complained of.

If the affidavit states that the department has reasonable cause to believe there is a pattern of conduct or common scheme in similar transactions, the records relevant to all such similar transactions shall be made available. Except as provided in subdivision (c), on petition of the department alleging the receipt of a consumer complaint within its jurisdiction and alleging that the lessor refuses to make available his records as required, the court shall order the lessor to make available such records or show cause why such records should not be produced. Section 2992.Specified print formA prospective assignee that provides a lessor under a lease contract with a preprinted form for use as a lease contract shall design the form in such a manner so as to provide on its face sufficient space for the lessor to include all disclosures and itemizations required pursuant to and shall also contain on its face a separate blank space no smaller than seven and one-half square inches for the lessor and lessee to memorialize trade-in, turn-in, and other individualized agreements. Section 2993.Subsequent assignment to skip trace, locate or repossess a vehicle; Notice requirementsA holder of a lease contract, or the agent of a holder, who has received a notice pursuant to Section 7507.6 of the Business and Professions Code, shall not make a subsequent assignment to skip trace, locate, or repossess the vehicle without simultaneously, and in the same manner by which the assignment is given, advising the assignee of the assignment of the information contained in the notice. As used in this section, “assignment” has the same meaning set forth in Section 7500.1 of the Business and Professions Code. This Website’s material is for informational purposes only. It is not legal advice, and it is not a substitute for legal advice.

This website does not create an attorney-client relationship with persons who view it. Prior to taking any action that could affect their legal rights, consumers should always and under all circumstances consult with a qualified lemon law and/or consumer rights attorney. The Vachon Law Firm is licensed to practice in the State of California, and not in any other jurisdictions. This Website’s information is solely and exclusively for California residents. It is not a solicitation for employment in any other jurisdiction.

The California standard residential lease agreement is structured around a one (1) year term, in which the tenant is legally bound to pay a monthly rent to maintain residency. It is highly recommended that the landlord conduct a background check on any applicant (See the ), due to information that can be uncovered that could sway the landlord’s decision on accepting the new tenant. If the landlord accepts, they may charge the new tenant with a security deposit usually equal to one (1) month’s rent (the State cap is two (2) months for unfurnished units and three (3) months for furnished units ). The deposit is to ensure that any damage to the property following the execution of the lease agreement will be covered.Laws – (See ) Versions. Standard Version.